See what a wallet actually holds—and how it's changing.

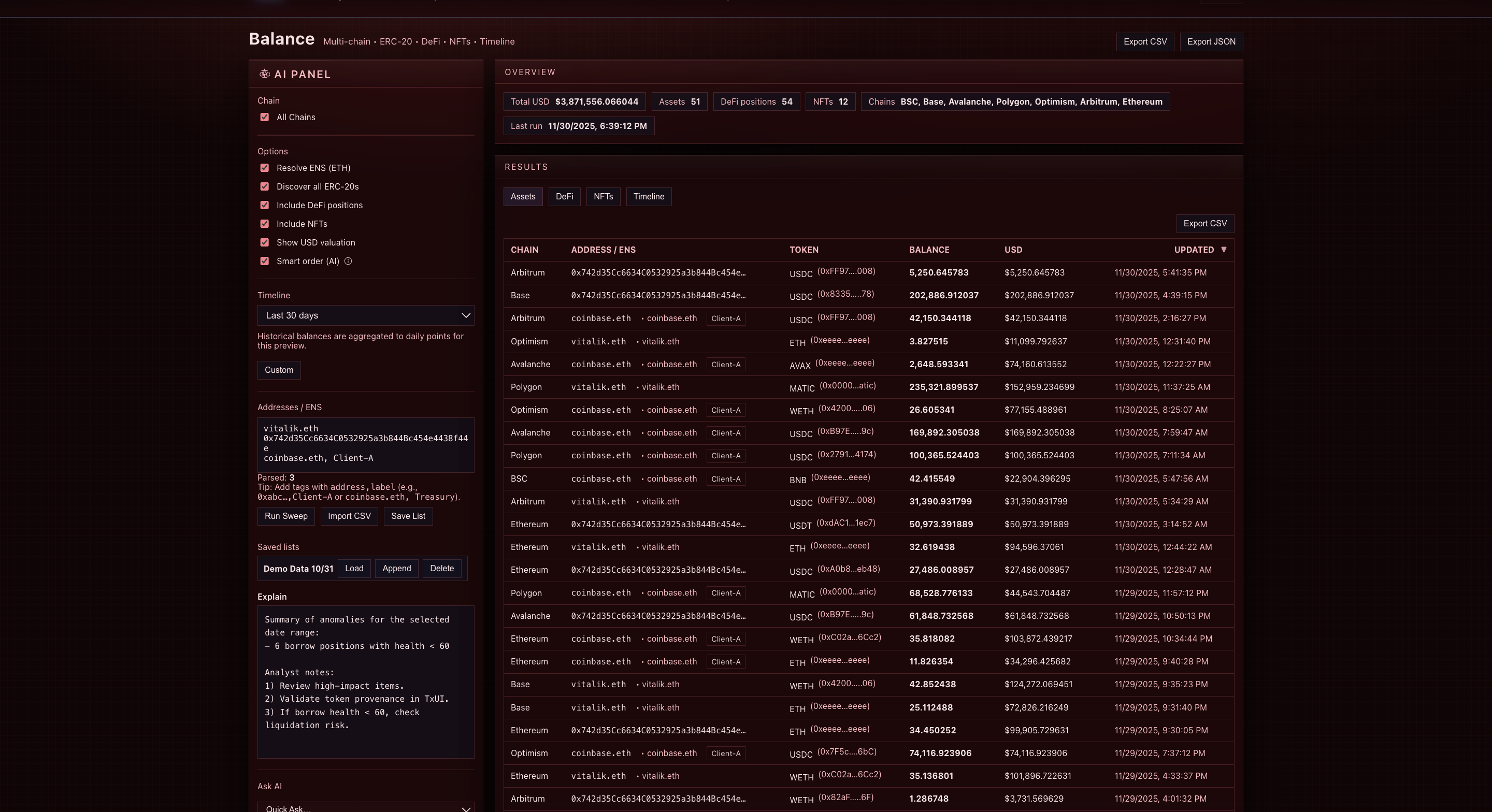

Cali Balance is the portfolio and exposure surface of the Cali platform. It aggregates assets, DeFi positions, NFTs, and historical balances across chains into one view so you can understand what a wallet actually represents—not just what a single transaction implies.

Useful for KYC reviews, ongoing monitoring, case investigations, and any situation where "what does this wallet hold?" is a core question.

A single transaction rarely reveals true exposure. Balance aggregates assets, NFTs, DeFi positions, and historical movements to show what a wallet actually holds across chains — not what a single transaction implies.

- Identifies concentration + diversification issues

- Highlights unusual or suspicious holdings

- Adds context for KYC refreshes and SAR investigations

- Multi-chain asset aggregation

- Quality signals (majors, stablecoins, illiquid assets)

- Concentration & diversification indicators

- Historical balance timelines

- AI summary of holdings

A wallet linked to an investigation unexpectedly holds $1.2M in illiquid tokens. Balance highlights concentration, surfacing potential scam-related allocations or wash-liquidity patterns.

- Aggregates fungible assets, NFTs, and DeFi positions across supported chains into a unified view.

- Shows concentration, diversification, and major components of a wallet's holdings.

- Tracks how balances move over time for trend and behavior analysis.

- Connects holdings to label, entity, and contract context from elsewhere in the Cali platform.

- Compliance and onboarding teams reviewing customer wallets and counterparties.

- Investigators trying to understand what a suspect or victim wallet really holds.

- Risk teams evaluating exposure to specific tokens, protocols, or segments.

- Law enforcement and forensics teams quantifying loss or seizure value.

The Balance AI panel helps interpret holdings in context: quality of assets, areas of concentration, and notable changes over time.

- Summarizes portfolio composition in plain language for non-technical stakeholders.

- Highlights high-risk or unusual assets and positions that may deserve closer review.

- Describes meaningful shifts in holdings over the selected window.

- Provides candidate language for KYC refreshes, periodic reviews, and investigation reports.

Balance is designed to help answer "how exposed are we, and to what?" while staying grounded in the data.

- Understand proportion of stablecoins, majors, long-tail tokens, and illiquid assets.

- Tie holdings back to Assets and Contract Intelligence for deeper quality review.

- Combine with Activity and Graph to see how holdings relate to flows and provenance.

- Use outputs directly in committee materials and internal discussions.

Balance is the wallet-centric complement to Activity, Graph, and OSINT.

- Use Activity to look at activity, then Balance to understand holdings and exposure.

- Pair Balance with Assets for token-level quality and Contract Intelligence for protocol risk.

- Carry findings into Report Station for write-up and filings.

Evaluate holdings and exposure in a way that stands up to review.

We recommend starting with known high-risk or high-value wallets in your own environment. That's where you'll quickly see whether Cali Balance gives you the clarity you need.