Understand the assets behind the balances.

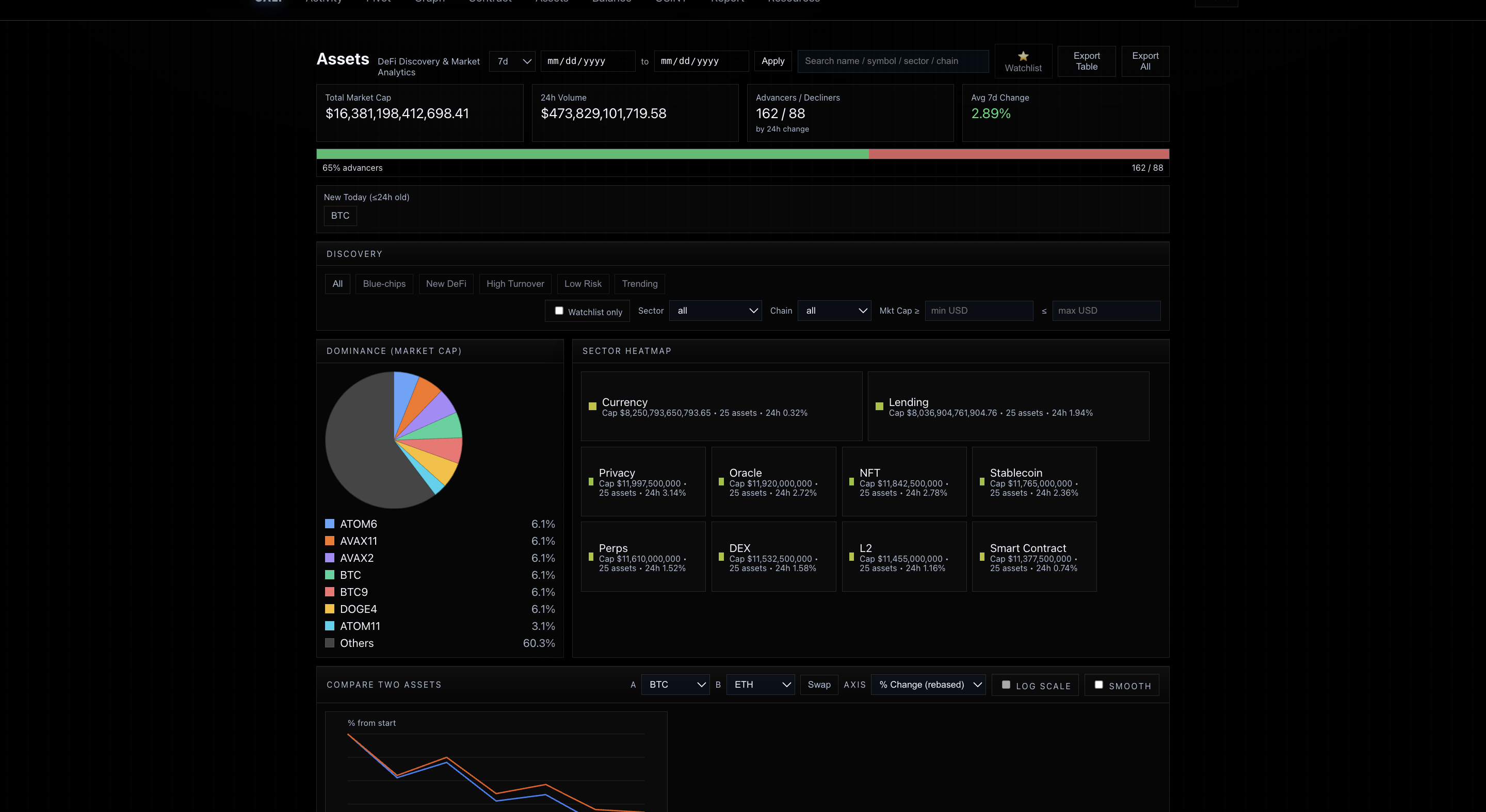

Cali Assets is the token- and asset-level intelligence surface of the Cali platform. It focuses on what specific assets are—liquidity, holders, behavior, and quality—so you can assess exposure appropriately.

Instead of treating every token as equal, Assets helps distinguish blue-chip collateral from illiquid, obscure, or risky instruments.

Investigators need reliable intelligence on token quality, liquidity, holders, risk characteristics, and exchange availability.

- Faster risk assessment for obscure tokens

- Supports escalation decisions

- Helps quantify exposure and liquidation feasibility

- Token profiles with liquidity and holder data

- Risk scoring and behavior patterns

- Exchange availability and trading depth

- Smart contract metadata

- AI summaries

A victim reports a wallet full of a new token. Assets shows extremely thin liquidity, flagged ownership concentration, and suspicious contract roles — supporting fraud escalation.

- Provides token-level views including supply, liquidity indicators, holders, and usage signals.

- Surfaces context about listings, age, deployment, and protocol relationships where available.

- Highlights asset categories and potential risk characteristics.

- Aligns token intel with how Balance, Activity, and Graph see those same assets in practice.

- Risk and compliance teams deciding which assets are acceptable for customers or products.

- Investigators assessing whether particular assets in a case are readily traceable or highly illiquid.

- Law enforcement and forensics teams quantifying loss or seizure potential in volatile or thin markets.

- Governance and product owners managing token lists, risk tiers, and guardrails.

The Assets AI panel helps translate raw asset properties into an understandable quality and risk perspective.

- Describes what makes an asset more or less liquid and how it is typically used.

- Highlights potential concerns such as centralization, thin liquidity, or historical incidents.

- Suggests how to think about the asset in the context of your risk tiers.

- Generates language that can be reused in approvals, memos, and listing decisions.

Assets gives you a way to talk about tokens beyond just price and ticker.

- Understand which assets in a portfolio are easy to move vs. hard to unwind.

- Tie assets back to Balance, Contract Intelligence, and Graph for context on real usage.

- Use this view to inform internal asset lists, limits, and product design.

Assets is the deeper asset-level companion to Balance and Contract Intelligence.

- Start with Balance to see holdings, then move into Assets to understand individual tokens.

- Use Contract Intelligence when an asset's behavior is driven by protocol design.

- Carry asset insights into Activity, Graph, and Report Station as part of casework and reviews.

Judge asset quality in the same place you investigate activity.

We suggest starting with the assets that already drive the most discussion internally—illiquid names, new listings, or tokens tied to active matters. That's where Cali Assets can make the biggest difference quickly.