Provenance and flow you can quote in a case file.

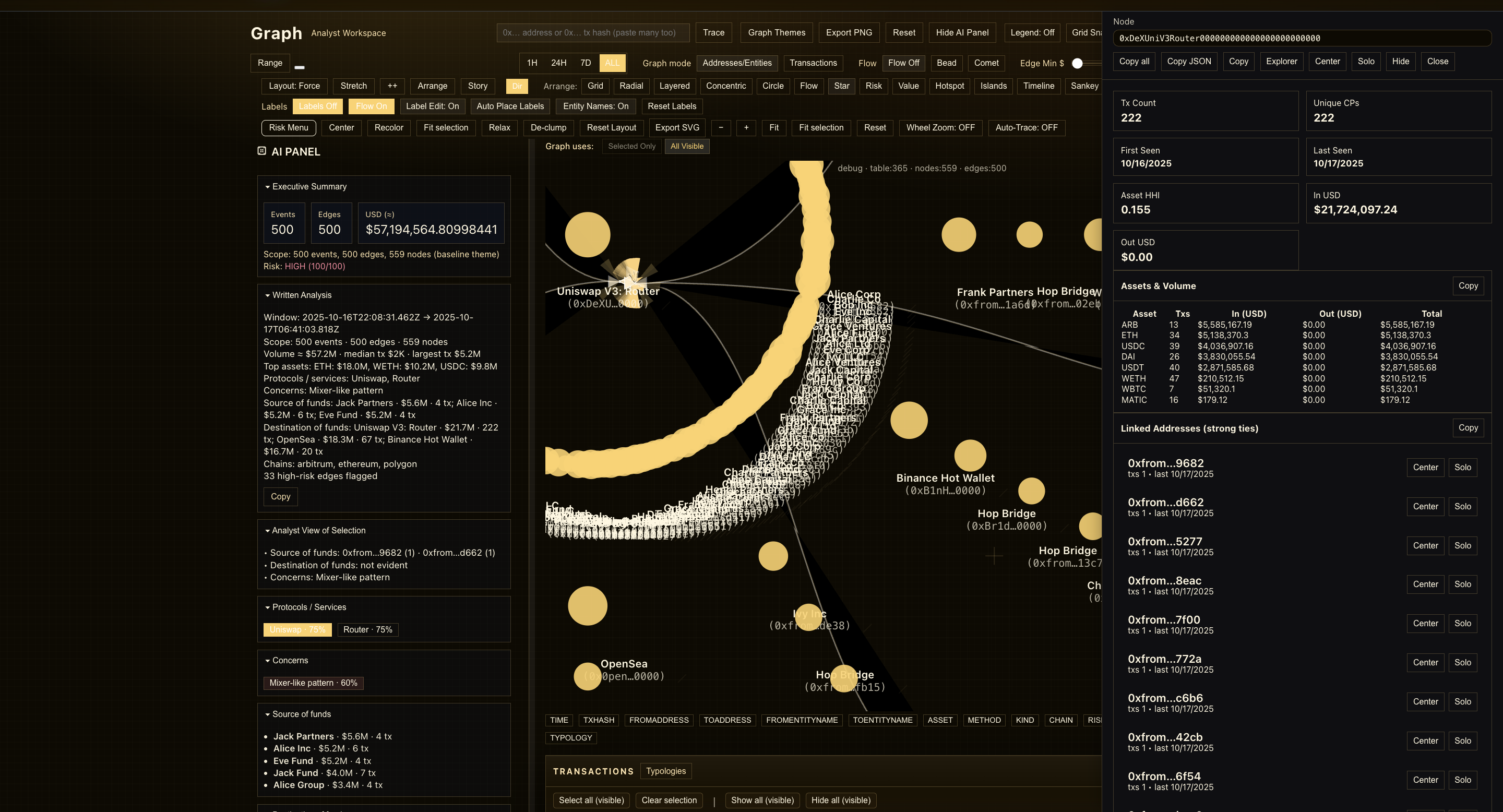

Cali Graph is the graph surface of the Cali platform. It shows how value moves across wallets, services, chains, mixers, and bridges—and converts those paths into narratives, not just visuals. Graph automatically traces value across hops, services, mixers, and chains—reducing manual tracing work and missed connections.

For investigators, compliance officers, and law-enforcement teams, Graph is where provenance becomes documentation suitable for affidavits, SARs, and briefings.

Tracing flows across mixers, bridges, hops, intermediaries, and cash-out points is time-consuming and error-prone. This module auto-traces and reconstructs provenance and highlights high-risk segments.

- Easily explainable flow paths

- Clear separation of victim funds vs unrelated movement

- Rapid mixer/bridge identification

- Multi-chain flow reconstruction

- Mixer/bridge detection

- Entity and risk overlays

- Select-mode for isolating suspicious paths

- Exposure view for inbound/outbound analysis

- Automated end-to-end flow tracing across wallets, services, mixers, bridges, and exchanges

A victim wallet sends funds through 3 intermediary hops to Tornado Cash, then to two separate exchanges. This module rebuilds the flow in seconds and marks the Tornado leg as high-risk with exposure percentages.

- Visualizes flows between wallets, entities, services, and contracts across chains.

- Highlights mixers, bridges, exchanges, and other intermediaries that matter to an investigation.

- Displays paths and clusters alongside the underlying transaction table from Activity.

- Helps teams explain where value came from, where it went, and what happened in between.

- Exchange and fintech compliance teams

- Banks and VASPs reviewing customer wallets and flows

- Crypto compliance & AML investigation teams

- Fraud, investigations, and recovery units

- Law-enforcement and public-sector forensic teams

AI reads the same metrics the investigator sees—nodes, edges, entity hints, labels, and services in view—and proposes candidate narratives for what happened in the flow.

- Summarizes provenance from a starting wallet or transaction to upstream sources of funds.

- Describes how value moves through mixers, bridges, DeFi protocols, and exchanges.

- Calls out notable intermediaries, clusters, and patterns relevant to a case.

- Produces draft language suitable for inclusion in reports, affidavits, and internal memoranda.

AI does not make the final decision; analysts remain in control. AI accelerates draft creation and reduces cognitive load.

Graph is designed for a world where flows move across chains and services quickly.

- Supports major L1 and L2 chains with alignment to Activity, Balance, and Assets.

- Treats mixers, bridges, and DeFi protocols as first-class components in flows.

- Aligns with OSINT Intelligence for sanctions, PEP, and adverse-media context on entities in the graph.

- Continues to evolve as new services and patterns emerge.

This module typically sits alongside Activity and Pivot in an investigation. It is where teams move from "we see suspicious activity" to "here is how the funds actually moved."

- Start in Activity to identify transactions of interest, then move to Graph to understand provenance and flow.

- Use OSINT Intelligence to add sanctions, PEP, and adverse-media posture to key nodes.

- Bring everything into Report Station when it's time to write up findings.

Show, don't tell, how the funds moved.

We recommend seeing Cali Graph on a real matter—victim funds, a fraud investigation, or a crypto exposure your team is already working. That's the fastest way to assess whether it meets your standard.